Approaching the Federal Marketplace

As companies seek to expand, at some point, they will look for opportunities within the federal market. Being successful in this arena takes dedication, strategic planning, and a different perspective on how to define and gauge success, as compared to other market verticals. The challenges can be daunting, and many of them can be made easier with some skilled guidance.

At Cognitio, we have a successful track record of helping companies to enter this highly regulated market, expand their current footprint, or recast themselves in a more positive light.

What is the Federal Market?

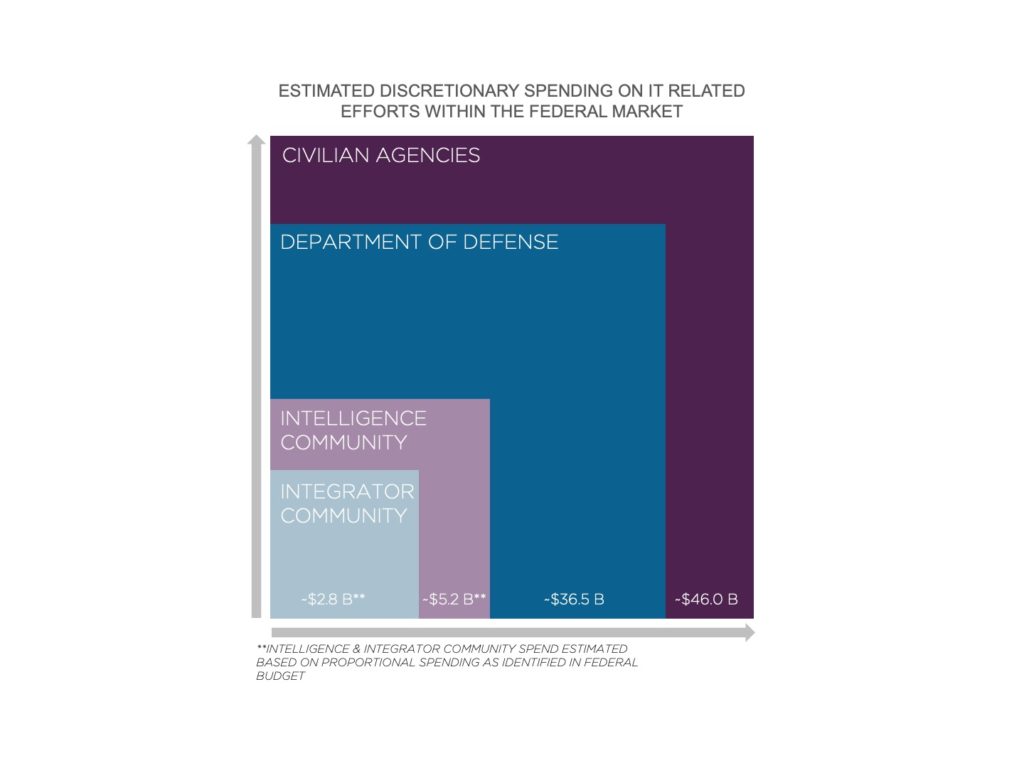

The federal government is enormous. The total budget in GFY2015 was almost $4 trillion dollars. Of that number, about $1.3 trillion is considered ‘discretionary’ spending, meaning it’s money that each agency can spend based on their needs and missions. Of that $1.3 trillion, only about $83 billion is spent on IT systems or technology. The real addressable space for any technology company is then some subset of the nearly $83 billion and that is divided into just over $36 billion for Defense and just over $46 billion for Civilian agencies.

Overall, the government consists of around 448 agencies (even the government isn’t sure how many there are), and each could be a potential buyer of a solution. To make it easier to understand this market space, Cognitio divides the government into four sub-segments to help companies start to develop specific strategies for the unique needs and missions of each segment.

Department of Defense (DoD):

When thinking about the DoD, most people automatically think of the armed forces: Air Force, Navy, Marines, and Army. However, the DoD also encompasses many other agencies such as Defense Information Systems (DISA); the Combatant Commands such as Special Operations, Central Command, etc; and, other support organizations like Defense Threat Reduction Agency (DITRA), or even the Defense Health Agency (DHA) that is a counterpart to the Veteran’s Administration. Approaching the DoD is not just marketing to the armed forces, but marketing and creating solutions for a myriad of inter-related groups.

The Intelligence Community (IC):

Most people think of the CIA or NSA when they think about the Intelligence Community, when in fact, there are seventeen or so agencies that are part of this group. Each IC entity has its own history, prestige, and place in the collection and analysis of information. Working with the IC presents unique challenges. Typically, meetings to understand the needs and missions of these organizations require cleared resources, in the long run. Issues with foreign ownership and control can cause delays or flat out shut some companies out of this market. Making in-roads requires the right kind of planning, and it can take years to make a sale.

Civilian Agencies:

Typically, companies think of the IRS, DHS, or FBI as the main representatives, but there are many agencies and components, both large and small, that are unique and approachable, such as Bureau of Prisons (BoP), Office of Justice Programs (OJP), or Health and Human Services (HHS) that also buy and utilize technologies in the delivery of their respective missions.

System Integrators:

One of the most commonly overlooked segments are the integrators and companies that serve the government. These companies, Lockheed, General Dynamics, BAE, Raytheon, and many others, procure and use a large amount of technology on behalf of the government. They also can be partners and provide channels for selling technology in the federal market, and a strategy to approach them is key to success.

Trends in government spend

The government programs spend over 3-5 year periods of time and each sub-market has specific needs and priorities. Some examples of current trends in spending include: DoD:

DoD:

- Support to the Warfighter is always the first and last priority for any spend that occurs and each branch has its own key initiatives.

- The Army, for example, is planning to spend $7.5 billion on data analysis, cyber operations and cloud migration.

- The Navy has budgeted $6.2 billion for force protection, cloud migration and their “pivot to the Pacific” strategy.

- The Defense Information Systems Agency (DISA) has allocated $4.5 billion on shared services, cloud, mobility and cyber.

Civilian Agencies:

- The key areas of concern are cyber security, analytics, and IT modernization.

- The Department of Health and Human Services (HHS) expects to spend $7.3 billion on predictive analysis and health analytics.

- Department of Homeland Security (DHS) allocated $5.8 billion on cyber, artificial intelligence and counter-terrorism programs.

- Finally, the Department of Veterans Affairs (VA) will spend $4 billion on cybersecurity and analytics to improve health care, with additional money set aside for a new Electronic Medical Records system.

Intelligence Community (IC):

- The IC budget and spend is classified.

- However, they are typically looking for artificial intelligence, enhanced cyber capability, and data analytics to help solve enduring national security issues.

- The National Intelligence Program provides insight into these initiatives and areas where companies can have impact on supporting national security.

Integrator Community:

- The integrators generally look for two things: unique technology to support current contracts, and partners who they can leverage to create differentiated solutions and offerings to win other contracts in support of mission opportunities.

- The key is to understand that they can be just as large as a government agency, and a strategy to approach various components of the larger integrators will be needed for success.

Keys to Success

Given the broad scope, spend and sub-markets, companies can quickly lose focus, fragment their strategy, and try to boil the ocean in order to gain in-roads. Without a well-thought strategy, companies become disillusioned, churn sales people, or find a small pocket that defines their success that is hard to leverage into additional business in other areas of the market.

Cognitio knows there are a few things you can do to really be successful in the Federal space:

- Be Sincere: If you really want success, understand the missions of the agencies and be dedicated to them and helping to solve their enduring issues. Insincerity and opportunism is quickly recognized and rooted out.

- Understand the Market: The typical sales cycle can be 18 to 36 months, and typically, it can’t be measured in quarter to quarter revenue. Companies who aren’t patient, sincere and dedicated fall to the wayside. Also, know that the market is highly regulated by the Federal Acquisition Regulations (FAR), or by the Defense version of those rules (D/FAR). In the end, contract vehicles and access to those contracts will provide pathways to revenue events.

- Know Where and Who to approach: You have to build a strong call plan, and do research. You need to build use cases showing your unique application to mission strategy, with a solid marketing point of view. Become part of the community that you want to serve, and earn a reputation as a part of the solution. There is no magic bullet, and your technology will not sell itself. You must build long-lasting relationships in order to succeed.

We Can Help

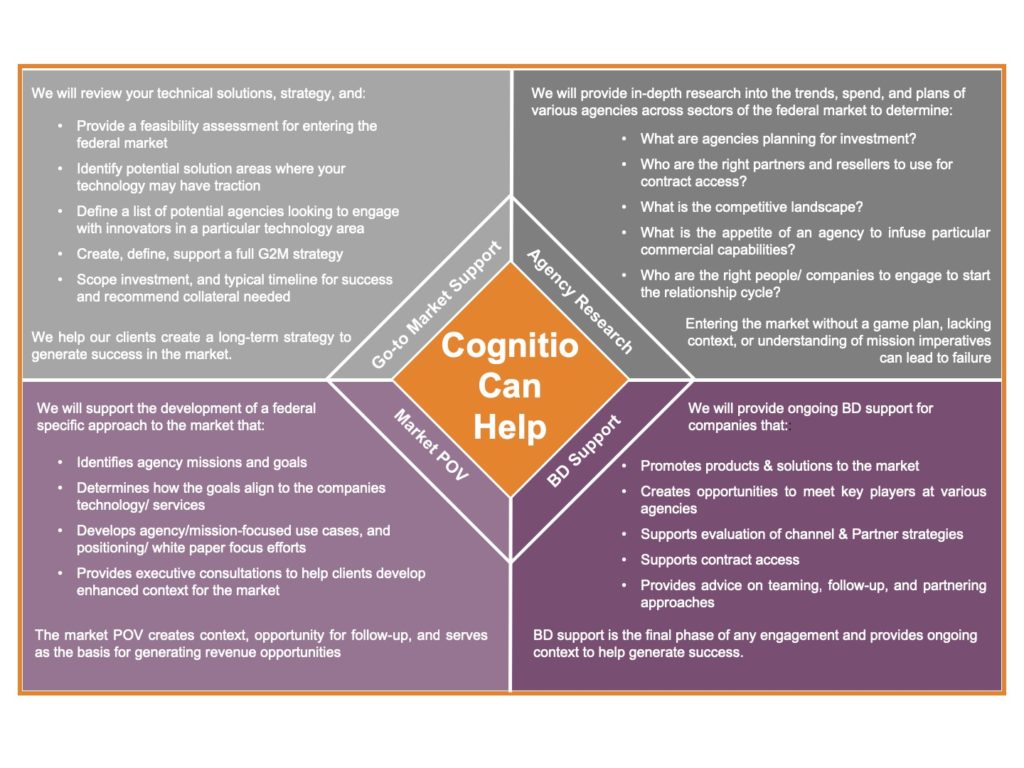

Cognitio is a strategic consulting and engineering firm established and managed by a team of former senior technology executives from the U.S. Intelligence Community and the corporate world. We have a long history of success in helping companies achieve their goals in the federal market.

Our work can scale to meet a variety of needs and is always accompanied by a discrete set of deliverables to help clients learn to help themselves.

Our standard SOWs are based around 4 activities: Go-to-Market Support, Agency Research, Market POV, and BD Support. We also offer more customized services depending on your needs.

Click HERE to book an initial 30-minute consultation with us now.

For more information, contact us at info@cognitiocorp.com, or call us 703-738-0068.